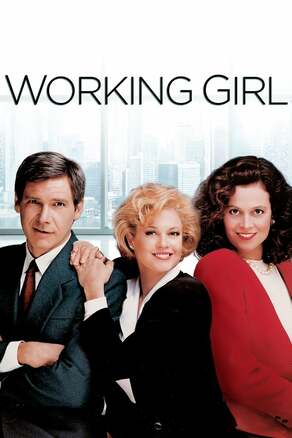

The first time I had ever heard of mergers and acquisitions was when I saw the 1988 movie “Working Girl”. I had no clue what it meant. I find that humorous now, because this is the fourth time that a company I have worked for has been acquired. Of the three previous, one turned out to be a great opportunity and the other two also brought opportunity. A “box of opportunity” and a severance package.

This acquisition is off to a great start. The new company has gone out of their way to make all the staff feel welcome and it looks like they really want to do interesting things that are going to benefit everyone.

I doubt this will be my last one. This is really the trend in business today and unless you work at a government job or are a couple of years from retirement, chances are, you might be facing one of these in your future.

Here’s three things I learned from my four times of coming out of a mandatory company meeting working for a different company.

TAKE YOUR VACATION TIME

It is not a law that employers award vacation time. So it is not written in stone that once the company you work for gets acquired, that they will honor it. I have seen all kinds of resolutions. I have seen it carried over, paid out and in one case of a company that had gone through bankruptcy and then been acquired, it was forgotten. I still remember a long time employee raising their hand and asking what would happen to their vacation and the old owner basically said, “That’s up to the new owners. And by the way, this office is closing and none of you are going to have jobs.” Some of those people had been there for over ten years and had built up vacation time like it was some kind of badge of honor. I am sure more than one sat in that meeting wishing they had at least done a couple of stay-cations.

If your company gives you vacation time, take your vacation time. Not only is work life balance important, but nothing in life is guaranteed. Especially not those five weeks you have been hoarding.

STOCK OPTIONS ARE IMPORTANT

I use to think stock options were kind of a joke. Especially when I was working for companies that were privately owned. I called it “pretend stock”. Until a company I worked for where I didn’t have stock options, got investors who bought out the options for the employees that did. Some of them paid off their student loans with that “pretend stock” pay out.

If you have stock options, review them and make sure you understand them. Look at your option price, how many shares you can buy and when the options expire.

Then look at them like you would a salary negotiation either when you are doing your annual review or getting ready to accept a new job offer. Get a lower option price or more shares and it might ease the pain of not getting the exact salary you were hoping for. You may not see any money immediately, but at acquisition time, you might be able to pay off some debt, or take a nice vacation.

ALL ACQUISITIONS ARE OPPORTUNITIES

You cannot control when or if the company you work for gets acquired. Worrying about it and fighting the change when it happens does nothing for you. Yes, even in the good ones, there is new ways of doing things, changes to procedures and maybe even a new boss or two. It also can mean more training opportunities, better benefits or more time off. Sometimes even the “box of opportunity”, although not anyone’s first choice, can push you into finding another career path. Maybe one that you were meant to be on all along.

RSS Feed

RSS Feed